Follow the Trucks: How “Hotspots” Can Guide Smarter Grid Investments for Commercial Fleets

If you want to future-proof infrastructure investments for electric trucks, go where the trucks are. Ports. Logistics hubs. Intermodal facilities. Distribution centers. These, and the essential service providers that keep goods moving, are the beating hearts of America’s commercial transportation economy. They’re also the logical hotspots for the early deployment of medium- and heavy-duty (M/HD) charging infrastructure.

Why does this matter? Because the success of commercial transportation electrification depends on building charging infrastructure where it will actually be used. While widespread M/HD adoption is still emerging, Public Utility Commissions and utilities have a unique opportunity to lead by making strategic investments in grid upgrades where freight electrification is most likely to take hold first; understanding hotspots is essential to do so.

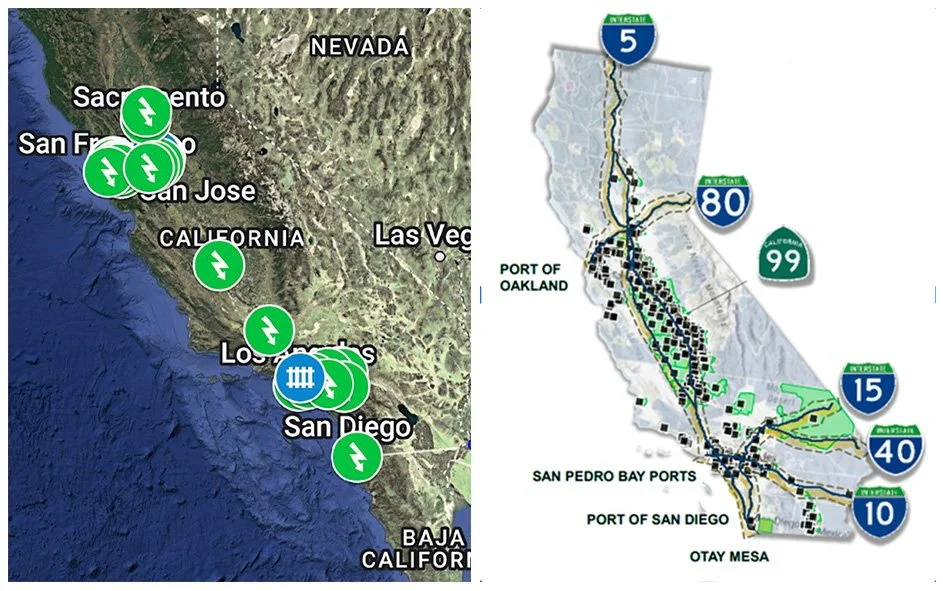

PACT believes hotspot mapping can serve as a shared roadmap for utilities, regulators, and fleet operators, enabling them to plan with precision and invest with confidence. That’s why we’ve developed one of the most strategic hotspot analyses to date in California, identifying regions where truck operations, land use, and grid capacity align to enable early, high-confidence deployment of charging infrastructure. By layering commercial trucking-activity data with existing infrastructure and planned development, PACT’s analysis highlights clusters where electrification can start first – offering “no regrets” investment zones for utilities and fleets.

Our goal isn’t to electrify every freight corridor overnight, but to help utilities and regulators make the most efficient use of limited grid resources by focusing early investments in areas where the data shows clear opportunity. As technology improves and fleet use expands, new hotspots will naturally emerge, but there is high certainty that the early sites will anchor the first wave of M/HD charging infrastructure.

Mapping the Movement of Goods

For decades, commercial trucks have followed predictable patterns, running the same routes between a concentrated network of facilities. The shift to M/HD electric vehicles won’t change those routes, but it will concentrate new kinds of demand in familiar places.

Today’s battery-electric trucks typically operate on shorter, repeatable routes, roughly 100 to 300 miles for regional and local trips. They pick up and deliver goods at the same depots, ports, and yards day after day, making those locations ideal for charging. Instead of trying to electrify every highway corridor or truck stop in the country, the more efficient path forward is to focus on the routes and areas where the trucks travel and park the most.

For utilities, this means aligning grid planning with freight planning—targeting substations, feeders, and rights-of-way that already intersect with freight clusters to avoid stranded assets elsewhere.

Hotspots are where electrification can scale fastest, most cost-effectively, and with certainty. At the national level, the National Zero-Emission Freight Corridor Strategy, released in early 2024 by the U.S. Departments of Transportation (DOT) and Energy (DOE), remains the guiding framework for M/HD electrification. The strategy lays out a nationally coordinated, phased buildout through 2040. While political and administrative shifts have affected the pace of federal implementation, many states continue to use the strategy as a foundation for regional infrastructure planning, and an antidote to the idea that electrification planning is “too uncertain” to act on.

State-Level Efforts to Identify Hotspots

Several states have already begun mapping hotspots to guide grid planning and investment and, crucially, to move to execution.

New York is among the most proactive. The Public Service Commission has directed utilities to pursue proactive infrastructure planning to support electrification in major logistics and distribution hubs. For example, Con Edison’s Hunt Point project in the Bronx offers a model for how hotspot mapping can guide investment in areas where demand for charging is most certain and community benefits are the greatest. The utility worked with regulators to plan grid upgrades and charging infrastructure in advance, instead of waiting for customers to request connections later. This kind of proactive planning ensures grid capacity will be ready where demand is most likely. New York’s Medium- and Heavy-Duty Zero-Emission Vehicle Action Plan further identifies priority freight corridors and warehouse clusters to help coordinate public and private charging deployment.

The California Energy Commission (CEC) and Caltrans are using freight flow and grid data through state and federal programs, including the National Electric Vehicle Infrastructure plan (NEVI) and California’s SB 1000 Electric Vehicle Infrastructure Assessment, to guide where to build truck charging infrastructure.

Washington State is developing a Medium- and Heavy-Duty Zero-Emission Vehicle Infrastructure Plan that integrates freight flow and grid-readiness data to target charging sites near ports, distribution centers, and major freight corridors like I-5.

And in New Jersey, the state is mapping freight activity and grid constraints to guide investments under its M/HD electric vehicle charging plan, which prioritizes industrial hubs and port areas in Newark, Elizabeth, and along the New Jersey Turnpike.

The Road Ahead

Still, hotspot mapping is only the starting point. Turning maps into real infrastructure requires coordination and commitment from utilities, regulators, fleet operators, and state agencies. Each has its own priorities and timelines, but progress depends on shared planning and early action.

For utilities, hotspot analysis can guide which substations to upgrade and where to prioritize capacity investments. For regulators, it can inform rate cases, distribution resource plans, and cost-recovery mechanisms that enable proactive—not reactive—investment in grid infrastructure.

Leading states like California and New York are positioned to embed hotspot-driven planning into their regulatory frameworks, moving from study to execution. By focusing early investments on high-traffic freight hubs and corridors, we can ultimately build out a national charging backbone that supports reliable, cost-effective, and scalable electrification. The data and tools exist; what’s needed now is the foresight to invest.